With a weak rand and a COVID-19 Lockdown cashflow crunch, here are 3 ways to ease cashflow with your IT hardware purchase decisions.

Just a few weeks into our South African experience of the Covid-19 epidemic, companies are faced with huge IT challenges. The way you procure IT hardware (and manage your existing hardware) over the next 6 months and beyond could help you free up valuable cashflow.

Some challenging market factors include:

- There is a shortage of IT hardware, particularly notebooks, in South Africa, and ETA’s are uncertain;

- The Rand is at an all-time low. New IT hardware will be expensive, and distributors may hold less stock and a smaller variety.

- Staff must be able to work from home introducing a new complexity for support and risk;

- Businesses will be wary of making purchase commitments in uncertain times.

- Tough economic conditions over the past few years has seen companies sweating outdated IT hardware and unsupported operating systems. This increases the risk of hardware failure and downtime and increases support and repair costs

- Cashflow is stretched coming out of a protracted lockdown.

Right now CASH RESERVES ARE KING, and businesses will need to spend cash on income generating activities or critical operational reserves.

When procuring IT hardware, you must also consider the following options to free up cashflow:

- Rent instead of buy: use the many benefits of renting hardware for those parts of your organisation where it makes sense. Understand the difference between Renting (Full maintenance & flexible) and Rental Finance (Long Term & cost of maintaining sits with you). There is place for both.

- Sell your unwanted IT Assets: Get rid of hardware that is gathering dust. Every month it loses value quickly and costs you money to store and manage. Companies like Dispose-IT will give you cash for your old IT hardware, and will assist with compliant disposal.

- Sale and Rent Back: Unlock cash from your existing IT assets. Go Rentals will buy your IT assets and rent it back to you with options of upgrading operating systems, extended warranties, theft and damage cover, and next day support.

Renting IT hardware is overwhelmingly compelling at this time. It does not have to be a decision right across your organisation, but it has a very important place.

You should consider these benefits:

- Cashflow: You will not need to use cash reserves.

- Flexibility: Flexible contract periods gives you flexibility in uncertain times, with the ability to return unwanted devices and reduce your costs if the business shrinks.

- Tax Benefit: Get the tax benefit immediately of any cash you spend. If you purchase up front, you have spent the cash but can only claim the expense for tax purposes over 36 months (depreciation). When you rent, each rand you spend is deductible in that tax period.

- Risk: Pass on the risk of theft, damage, repair costs, reverse logistics and management thereof to the rental company.

- Certainty: Rental fixes your monthly costs. Especially now, IT budgets cannot be variable.

- Ensure Uptime: Every second costs money. If a rental device doesn’t work, swap it out.

- Not everyone needs a new PC. When a new employee joins your company, does he/she always get a new PC? No. They get a ‘hand-me-down’. I have seen staff who have to put stickers on their keyboards to rewrite the letters on keys! A used rented device will meet certain quality standards, and can be swapped if lettering rubs off.

- Support: Supporting a distributed workforce will be a challenge. Companies may go in and out of lockdown, and more staff will work from home. Companies do not have a budget for a large internal IT team right now. Lean on the logistics capabilities of a rental provider that has the infrastructure to support staff at home.

- Free up support budget: Repairing a PC and reloading the OS on your owned device costs you more than you think, sometimes equal to many months rental. Support staff (inhouse or outsourced) are expensive, and the cost of downtime is even more.

- Delay capex spend: Even if you are set on purchasing, renting can buy you time until you are ready to spend. Regardless of the method, you adopt to acquire IT hardware (cash upfront, or a method of finance), there is always a monthly cost in your books (a depreciation expense). Simply replace that with a rental cost in the interim.

How to decide what to buy and what to rent?

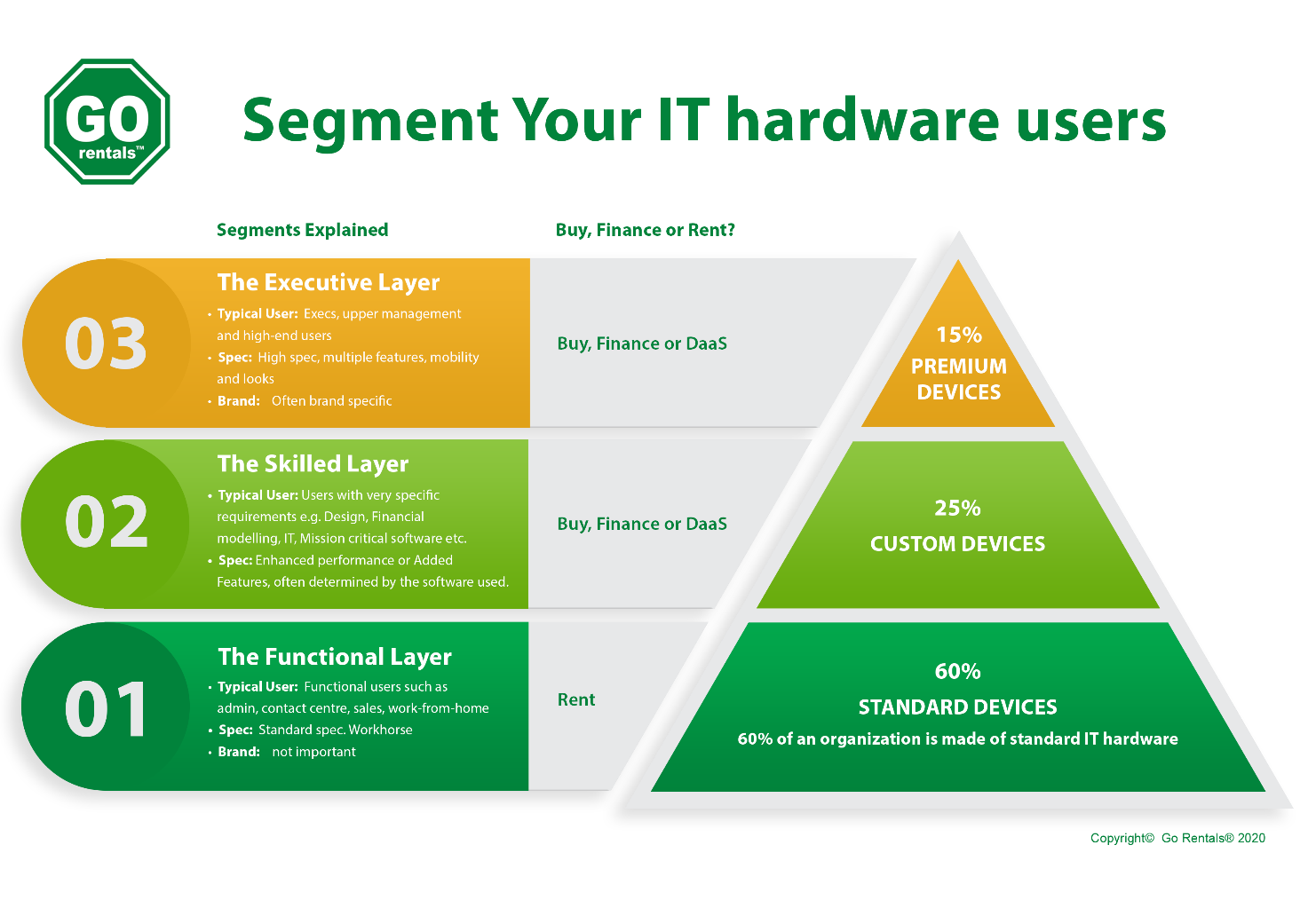

You do not need a one-size-fits-all decision for the whole company. Segment your company into layers based on their requirements to help you decide. An example is shown in the image above.

Purchase where it makes sense for your business. But consider rental for other layers of your business, it will save you money and give you the flexibility you need to be nimble in these periods.

If you are unfamiliar with rentals, we usually give customers this advice: The bulk of the IT hardware in most organisations sits with standard users, and is a commodity. Staff numbers can increase and decrease, and you need to keep the cost per user low. Focus on renting for a portion of this layer as a start, and you will soon see benefit.

Look out for our next article: Demystifying Technology Rentals.

- Short Term

- Long Term

- Rental Finance

- Hardware/Device as a Service

About the Authors:

Evan Berger has over 18 years of experience in IT hardware, rentals and IT asset finance. Evan holds an BSc. and MSc.degrees. He is the founder and CEO of Go Rentals.

Evan Berger has over 18 years of experience in IT hardware, rentals and IT asset finance. Evan holds an BSc. and MSc.degrees. He is the founder and CEO of Go Rentals.

Ron Keschner has over 20 years of experience in the IT Channel. He is the Sales Director of Go Rentals, and was the Managing Director of Channel Capital.

Ron Keschner has over 20 years of experience in the IT Channel. He is the Sales Director of Go Rentals, and was the Managing Director of Channel Capital.

The views and opinions expressed in this article are those of the authors, and the decisions required may differ from company to company. Companies should make their own analysis and obtain financial advice where necessary that is relevant to their circumstances.